📅 Upcoming UK Tax Deadlines Every Small Business Should Know

- Aleksandar Davidov

- Sep 5, 2025

- 1 min read

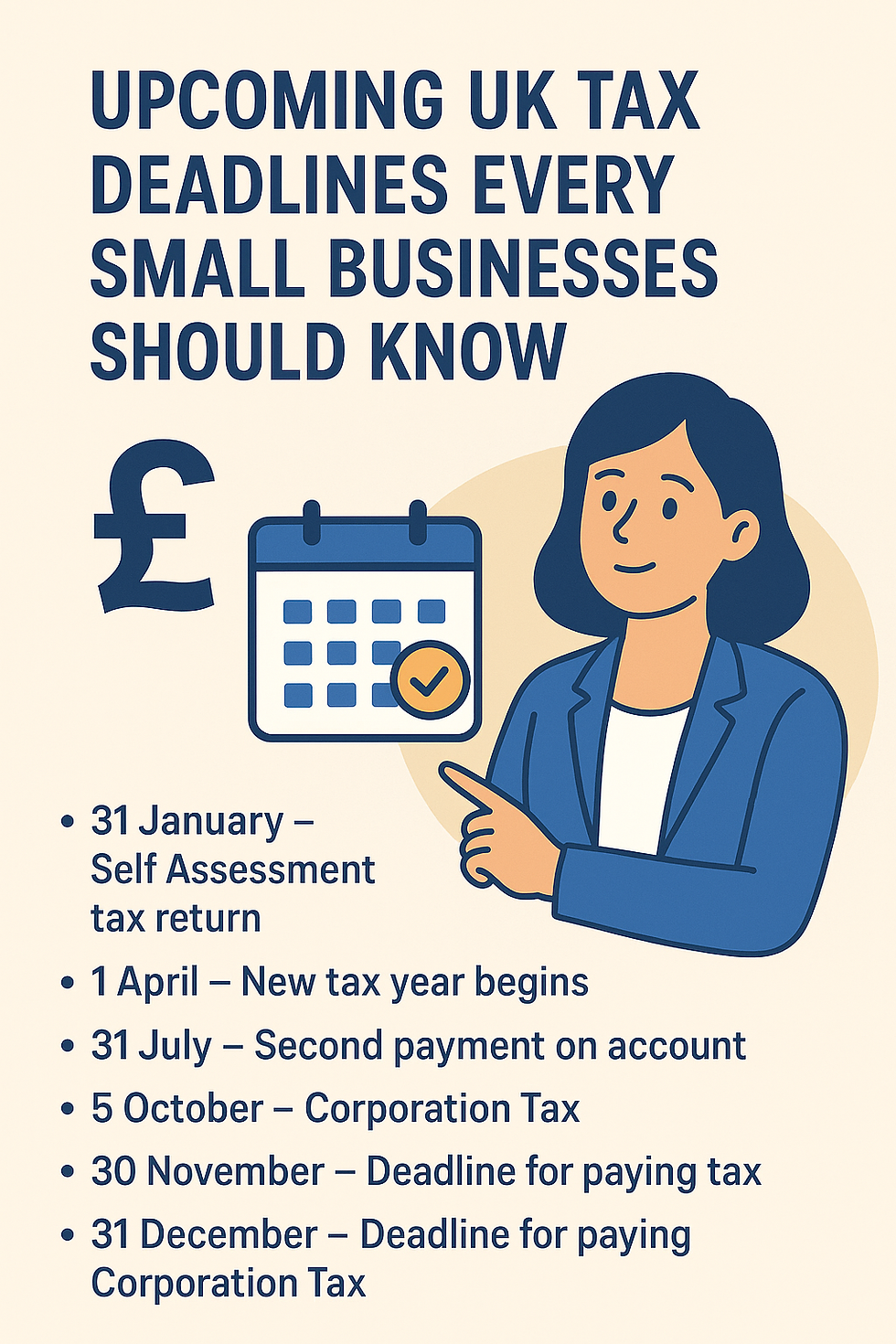

Staying on top of tax deadlines is crucial – missing one can mean penalties, interest, and unnecessary stress. Here are the key dates every small business owner should have in their diary:

✅ 31 January 2026 – Deadline for filing your 2024/25 Self Assessment tax return online and paying any tax due.

✅ 1 April 2026 – VAT return deadline for businesses with a quarterly VAT period ending 28 February 2026.

✅ 6 April 2026 – Start of the new tax year (time to update your payroll, personal allowances, and dividend planning).

✅ 19 April 2026 – Deadline for PAYE and NIC submissions (if paying by post).

✅ 22 April 2026 – PAYE and NIC deadline (if paying electronically).

✅ 31 July 2026 – Second payment on account for Self Assessment (if applicable).

💡 Top Tip: Use accounting software with deadline reminders or sync these dates into your digital calendar. A little organisation goes a long way in avoiding HMRC fines.

👉 Which of these dates do you always find the trickiest to manage?

📞+44 20 3302 3932 2200 3302 3932

📞 +44 7939 952432

Comments